Looking to start off 2021 on the right foot?

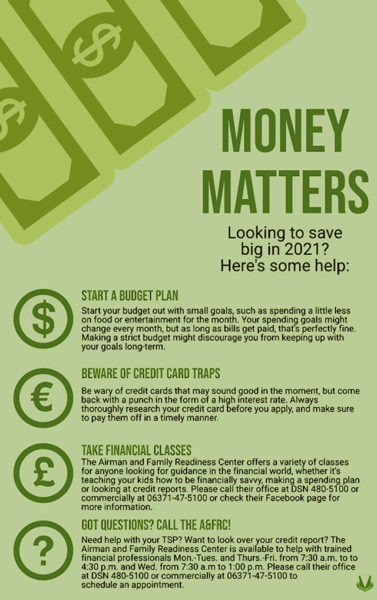

Whether it’s making a budget, taking financial classes or finding the right credit card, these are all great ways to start off the new year.

An excellent approach to being financially savvy is to watch spending and make a budget. Tools needed for this project could be as simple as a pen and paper to start writing down monthly expenses and spending goals. Many phone apps also specialize in tracking spending.

The beginning is the most important step, but going cold turkey with budget plans could also be a recipe for giving up too early, according to Angie Fields, Airman and Family Readiness Center readiness consultant.

“You need to remember a spending plan is flexible and you need to be flexible,” Fields said. “You can’t be so rigid in what you’re doing that you’re not willing to make changes.”

Be prepared for a budget to be malleable and change every month, Fields said. Starting with small goals, such as spending a little less on entertainment each month, is a great way to go forward.

“Pick and choose what you want to have fun with,” Fields said. “I love going to coffee shops. I go every day, but I also say, ‘Okay, if I want to pay $4.50 for this cup of coffee twice a week, then I know there’s something else that I cannot do.”

Another way to start practicing good financial habits is to take one of several financial classes available at the A&FRC.

As an instructor at the A&FRC, Fields offers many different classes, from “Developing a Spending Plan” to “Credit Reports” to “Raising Financially Fit Children.” Classes are currently conducted through web conference calls due to COVID-19.

Spending habits can boil down to personality, which is why Fields gives her students activities to find what kind of spender they are and develop good spending plans from there.

“Everybody has a (different) attitude about money and how they spend it,” Fields said. “When you’re doing a budget, you have to address whatever their attitude is. ‘Are you a carefree person with your money?’ ‘Are you that person who likes to plan?’ ‘Do you like to help everybody else?’ This is a big part of what we do.”

Fields has been teaching these courses for 15 years. Her expertise also comes from her own personal experience with financial difficulties.

“(With) my first credit card, I bought a set of luggage that was not any more than $300,” Fields recalls. “It took me close to four years to pay that luggage off because I was a college student and I was only paying the minimum payments every month. It took me four years to pay it off because the interest rate was 10% or 12%, which was big for 1987. Everybody’s got to learn.”

With her cautionary tale in mind, Fields also advises consumers to be wary of credit cards from certain retailers.

“They’ll say, ‘Oh if you get a credit card with us, we’ll take 10% off!’” Fields said. “If whatever you bought from that store was $100 they took $10 off. If you don’t pay that $90 back next month, they’re going to hit you with an interest rate that’s going to be about 15% to 20%. The savings you had when you got that $10, you have now given back because you didn’t pay it off at the end of the month.”

Other advice Fields can share for military families with civilian spouses is to prepare for permanent change of station moves by treating one spouse’s income as a bonus to the others’ income.

“That way you’re not trying to live on (past) income while your spouse is trying to find a job,” Fields said. “You’ve already planned ahead because you know how to live on one income.”

Finally, with tax season ahead, Fields advises everyone to check their income tax and make sure they’re claiming their dependents.

With these tips in mind, setting someone up for financial success doesn’t have to be a monumental task.

Anyone looking for financial advice is welcome to call the Ramstein A&FRC at DSN 480-5100 or commercially at 06371-47-5100 to schedule an appointment. The Ramstein A&FRC also has a Facebook page where they post updates about events and financial help classes.