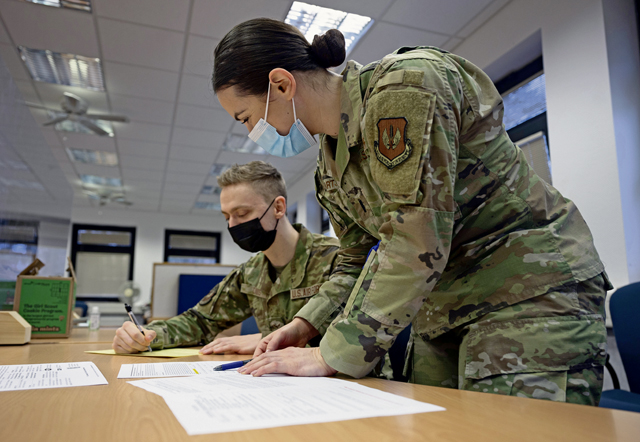

The 86th Airlift Wing Legal Office Tax Center has officially opened and is offering tax services to members the Kaiserslautern Military Community at Ramstein Air Base, Feb. 16.

The 86 AW Legal Office opened the Tax Center located at building 2137 to assist members of the KMC their who fall under the Status of Forces Agreement with their tax needs and are able to work face-to-face with one of the seven volunteers at no cost to them.

“The Ramstein Tax Center is a one-stop-shop where Airmen and their dependents can get their taxes done with the help of our awesome volunteers,” said 1st Lt. Ashley Hartshorn, Ramstein Tax Center officer in charge. “No one likes doing their taxes, but we are here to make it an easier and less stressful process.”

In the past few years the Tax Center has had to provide their services virtually. Now it is available by appointment and able to be done in person with a volunteer.

“We were only doing virtual services because of COVID-19, but now we are open for in person appointments so you can do your taxes much faster,” said U.S. Air Force Staff Sgt. Anekunle Akande, the non-commissioned officer in charge of the Ramstein Tax Center. “All of our volunteers undergo training provided by the Internal Revenue Service and are fully qualified to help you with your needs.”

Members of the Kaiserslautern Military Community are encouraged to use the service and take advantage of the benefits. Also the tax center is always looking for volunteers to help out and as an added benefit will be able to become more acquainted with the tax preparation process.

“The service we are providing is a way for us to give back to the community, which gives us so much,” Hartshorn said. “We are always happy to see people come and volunteer with us to help out. It’s also great to help out because those who volunteer will gain a significant understanding of the tax process. It provides a big impact on the community we all live in a makes it a better place for everyone.”

The Tax Center cannot complete returns involving certain circumstances. Volunteers are standing by to inform members of the Kaiserslautern Military Community what services they can and cannot complete.

“There are certain returns we cannot complete because of the rules we follow,” Akande said. “We cannot file returns involving foreign taxes or income, virtual currency, sale of rental properties, rental properties in more than one state or home businesses. We are happy to help in every other way we can and get people the tax services they need.”

For more information about the Ramstein Tax Center or how to volunteer visit 86 AW Legal Facebook page, send an e-mail to 86aw.ja.ramsteintaxcenter@us.af.mil or call +49-6371-47-1040 or DSN 480-1040.